The Higher Education Inquirer has recently received a Freedom of Information (FOIA) response regarding student loan debt held by former Liberty University students. The FOIA was 25-01941-F.

Upcoming Events: April 8th, Kill the Cuts (Nationwide), Protest at ASU+GSV (San Diego). April 17th Fight for Higher Education (Nationwide). Send tips to Glen McGhee at gmcghee@aya.yale.edu.

Search This Blog

Thursday, March 20, 2025

Wednesday, March 19, 2025

More than 290,000 Liberty University student loan debtors owe more than $8 Billion

The Higher Education Inquirer has recently received a Freedom of Information (FOIA) response regarding student loan debt held by former Liberty University students. The FOIA was 25-01939-F.

Monday, March 17, 2025

265,000 DeVry student loan debtors owe $5.2 Billion

The Higher Education Inquirer has recently received a Freedom of Information (FOIA) response regarding student loan debt held by former DeVry University students. The FOIA was 25-01942-F.

Tuesday, March 4, 2025

The Future of Federal Student Loans

The U.S. student loan system, now exceeding $1.7 trillion in debt and affecting over 40 million borrowers, is facing significant challenges. As political pressures rise, the management of student loans could be significantly altered. A combination of potential privatization, the elimination of the U.S. Department of Education (ED), and a new role for the Department of the Treasury raises critical questions about the future of the system.

U.S. Department of Education: Strained Resources and Outsourcing

The U.S. Department of Education (ED) is responsible for managing federal student loan servicing, loan forgiveness programs, and borrower defense to repayment (BDR) claims. However, ED has faced ongoing issues with understaffing and inefficiency, particularly as many functions have been outsourced to contractors. Companies like Maximus (including subsidiaries like AidVantage) manage much of the administrative burden for loan servicing. This has raised concerns about accountability and the impact on borrowers, especially those seeking loan relief.

In recent years, ED has also experienced staff reductions and funding cuts, making it difficult to process claims or maintain high-quality service. The potential for further cuts or even the elimination of the department could exacerbate these problems. If ED’s role is diminished, other entities, such as the Department of the Treasury, could assume responsibility for managing the student loan portfolio, though this would present its own set of challenges.

Potential for Privatization of the Student Loan Portfolio

One of the most discussed options for addressing the student loan crisis is the privatization of the federal student loan portfolio. Under previous administration discussions, including those during President Trump’s tenure, there were talks about selling off parts of the student loan portfolio to private companies. This would be done with the aim of reducing the federal deficit.

In 2019, McKinsey & Company was hired by the Trump administration to analyze the value of the student loan portfolio, considering factors such as default rates and economic conditions. While the report's findings were never made public, the idea of transferring the loans to private companies—such as banks or investment firms—remains a possibility.

The consequences of privatizing federal student loans could be significant. Private companies would likely focus on profitability, which could result in stricter repayment terms or less flexibility for borrowers seeking loan forgiveness or other relief options. This shift may reduce borrower protections, making it harder for students to challenge repayment terms or pursue loan discharges.

The Department of the Treasury and its Potential Role

If the U.S. Department of Education is restructured or eliminated, there is a possibility that the Department of the Treasury could step in to manage some aspects of the student loan portfolio. The Treasury is responsible for the country’s financial systems and debt management, so it could, in theory, handle the federal student loan portfolio from a financial oversight perspective.

However, while the Treasury has experience in financial management, it lacks the specialized knowledge of student loans and borrower protections that the Department of Education currently provides. For example, the Treasury would need to find ways to process complex Borrower Defense to Repayment claims, a responsibility ED currently manages. In 2023, over 750,000 Borrower Defense claims were pending, with thousands of claims related to predatory practices at for-profit colleges such as University of Phoenix, ITT Tech, and Kaplan University (now known as Purdue Global). Additionally, some of these for-profit schools were able to reorganize and continue operating under different names, further complicating the situation.

The Treasury could also contract out loan servicing, but this could increase reliance on profit-driven companies, possibly compromising the interests of borrowers in favor of financial performance.

Borrower Defense Claims and the Impact of For-Profit Schools

A large portion of the Borrower Defense to Repayment claims comes from students who attended for-profit colleges with a history of deceptive practices. These institutions, often referred to as subprime colleges, misled students about job prospects, program outcomes, and accreditation, leaving many with significant student debt but poor employment outcomes.

Data from 2023 revealed that over 750,000 Borrower Defense claims were filed with the Department of Education, many of them against for-profit institutions. The Sweet v. Cardona case showed that more than 200,000 borrowers were expected to receive debt relief after years of waiting. However, the process was slow, with an estimated 16,000 new claims being filed each month, and only 35 ED workers handling these claims. These delays, combined with the uncertainty around the future of ED, leave borrowers vulnerable to prolonged financial hardship.

Lack of Transparency and Accountability in the System

While the U.S. Department of Education tracks Borrower Defense claims, it does not publish institutional-level data, making it difficult to identify which schools are responsible for the most fraudulent activity.

In response to this, FOIA requests have been filed by organizations like the National Student Legal Defense Network and the Higher Education Inquirer to obtain detailed information about which institutions are disproportionately affecting borrowers.

The lack of transparency in the system makes it harder for borrowers to make informed decisions about which institutions to attend and limits accountability for schools that have harmed students. If the Treasury or private companies take over management of the loan portfolio, these transparency issues could worsen, as private entities are less likely to prioritize public accountability.

Conclusion

The future of the U.S. student loan system is uncertain, particularly as the Department of Education faces the potential of funding cuts, staff reductions, or even complete dissolution. If ED’s role diminishes or disappears, the Department of the Treasury could take over some functions, but this would raise questions about the fairness and transparency of the system.

The possibility of privatizing the student loan portfolio also looms large, which could shift the focus away from borrower protections and toward financial gain for private companies. For-profit schools, many of which have a history of predatory practices, are responsible for a disproportionate number of Borrower Defense claims, and any move to privatize the loan portfolio could exacerbate the challenges faced by borrowers seeking relief from these institutions.

Ultimately, there is a need for greater transparency and accountability in how the student loan system operates. Whether managed by the Department of Education, the Treasury, or private companies, protecting borrowers and ensuring fairness should remain central to any future reforms. If these issues are not addressed, millions of borrowers will continue to face significant financial hardship.

Saturday, February 8, 2025

What now for the US Department of Education?

What happens now with the US Department of Education now that Elon Musk claims that it no longer exists? It's hard to know yet, and even more difficult after removing career government workers that we have known for years.

We are saddened to hear of contacts we know who have been fired: hard working and capable people, in an agency that has been chronically understaffed and politicized.

We also worry for the hundreds of thousands of student loan debtors who have borrower defense to repayment claims against schools that systematically defrauded them--and have not yet received justice.

And what about all those FAFSA (financial aid) forms for students starting and continuing their schooling? How will they be processed in a timely manner?

Without funding and oversight, the Department of Education looks nearly dead. But with millions of poor and disabled children relying on Title I funding and IDEA and tens of millions more with federal student student loans, it's hard to imagine those functions disappearing for good.

Let's see how much slack is taken up by private enterprise and religious nonprofits who may benefit from the pain. With student loans, much of the work has already been contracted out. It would not be out of the question for the student loan portfolio to be sold off to corporations who could profit from it. And that may or may not require Congressional approval.

Friday, January 24, 2025

U.S. Department of Education's Trump Appointees and America First Agenda

The U.S. Department of Education has announced a team of senior-level political appointees who will support the implementation of President Trump’s America First agenda.

The Trump Administration, by Executive Order, has already required colleges and universities to eliminate diversity, equity and inclusion measures and schools are scrambling to be compliant with this new federal policy. New policies may also affect grants from the Department of Health and Human Services, which includes the Food and Drug Administration, the Centers for Disease Control and Prevention, and the National Institutes of Health.

Notable actions the Department of Education has already taken include:

- Dissolution of the Department’s Diversity & Inclusion Council, effective immediately;

- Background:The Diversity & Inclusion Council was established following Executive Order 13583 under then - President Obama. President Trump has rescinded the Executive Orders that guide the Council and issued a new Executive Order, “Ending Radical and Wasteful Government DEI Programs and Preferencing,” that terminates groups like the Diversity & Inclusion Council. DEI documents issued and related actions taken by the Council have been withdrawn.

- Dissolution of the Employee Engagement Diversity Equity Inclusion Accessibility Council (EEDIAC) within the Office for Civil Rights (OCR), effective immediately and pursuant to President Trump’s Executive Order “Ending Radical and Wasteful Government DEI Programs and Preferencing”;

- Cancellation of ongoing DEI training and service contracts which total over $2.6 million;

- Withdrawal of the Department’s Equity Action Plan;

- Placement of career Department staff tasked with implementing the previous administration’s DEI initiatives on paid administrative leave; and

- Identification for removal of over 200 web pages from the Department’s website that housed DEI resources and encouraged schools and institutions of higher education to promote or endorse harmful ideological programs.

At least four appointees to the Department of Education, as well as including incoming Secretary of Education Linda McMahon, have worked at the America First Policy Institute (AFPI). AFPI's higher education proposals are posted here and noted at the bottom of this article. AFPI has been accused of using dark money to prevent student loan forgiveness and its rhetoric clearly advances this agenda.

Rachel Oglesby – Chief of Staff

Rachel Oglesby most recently served as America First Policy Institute's Chief State Action Officer & Director, Center for the American Worker. In this role, she worked to advance policies that promote worker freedom, create opportunities outside of a four-year college degree, and provide workers with the necessary skills to succeed in the modern economy, as well as leading all of AFPI’s state policy development and advocacy work. She previously worked as Chief of Policy and Deputy Chief of Staff for Governor Kristi Noem in South Dakota, overseeing the implementation of the Governor’s pro-freedom agenda across all policy areas and state government agencies. Oglesby holds a master’s degree in public policy from George Mason University and earned her bachelor’s degree in philosophy from Wake Forest University.

Jonathan Pidluzny – Deputy Chief of Staff for Policy and Programs

Jonathan Pidluzny most recently served as Director of the Higher Education Reform Initiative at the America First Policy Institute. Prior to that, he was Vice President of Academic Affairs at the American Council of Trustees and Alumni, where his work focused on academic freedom and general education. Jonathan began his career in higher education teaching political science at Morehead State University, where he was an associate professor, program coordinator, and faculty regent from 2017-2019. He received his Ph.D from Boston College and holds a bachelor’s degree and master’s degree from the University of Alberta.

Chase Forrester – Deputy Chief of Staff for Operations

Virginia “Chase” Forrester most recently served as the Chief Events Officer at America First Policy Institute, where she oversaw the planning and execution of 80+ high-profile events annually for AFPI’s 22 policy centers, featuring former Cabinet Officials and other distinguished speakers. Chase previously served as Operations Manager on the Trump-Pence 2020 presidential campaign, where she spearheaded all event operations for the Vice President of the United States and the Second Family. Chase worked for the National Republican Senatorial Committee during the Senate run-off races in Georgia and as a fundraiser for Members of Congress. Chase graduated from Clemson University with a bachelor’s degree in political science and a double-minor in Spanish and legal studies.

Steve Warzoha – White House Liaison

Steve Warzoha joins the U.S. Department of Education after most recently serving on the Trump-Vance Transition Team. A native of Greenwich, CT, he is a former local legislator who served on the Education Committee and as Vice Chairman of both the Budget Overview and Transportation Committees. He is also an elected leader of the Greenwich Republican Town Committee. Steve has run and served in senior positions on numerous local, state, and federal campaigns. Steve comes from a family of educators and public servants and is a proud product of Greenwich Public Schools and an Eagle Scout.

Tom Wheeler – Principal Deputy General Counsel

Tom Wheeler’s prior federal service includes as the Acting Assistant Attorney General for Civil Rights at the U.S. Department of Justice, a Senior Advisor to the White House Federal Commission on School Safety, and as a Senior Advisor/Counsel to the Secretary of Education. He has also been asked to serve on many Boards and Commissions, including as Chair of the Hate Crimes Sub-Committee for the Federal Violent Crime Reduction Task Force, a member of the Department of Justice’s Regulatory Reform Task Force, and as an advisor to the White House Coronavirus Task Force, where he worked with the CDC and HHS to develop guidelines for the safe reopening of schools and guidelines for law enforcement and jails/prisons. Prior to rejoining the U.S. Department of Education, Tom was a partner at an AM-100 law firm, where he represented federal, state, and local public entities including educational institutions and law enforcement agencies in regulatory, administrative, trial, and appellate matters in local, state and federal venues. He is a frequent author and speaker in the areas of civil rights, free speech, and Constitutional issues, improving law enforcement, and school safety.

Craig Trainor – Deputy Assistant Secretary for Policy, Office for Civil Rights

Craig Trainor most recently served as Senior Special Counsel with the U.S. House of Representatives Committee on the Judiciary under Chairman Jim Jordan (R-OH), where Mr. Trainor investigated and conducted oversight of the U.S. Department of Justice, including its Civil Rights Division, the FBI, the Biden-Harris White House, and the Intelligence Community for civil rights and liberties abuses. He also worked as primary counsel on the House Judiciary’s Subcommittee on the Constitution and Limited Government’s investigation into the suppression of free speech and antisemitic harassment on college and university campuses, resulting in the House passing the Antisemitism Awareness Act of 2023. Previously, he served as Senior Litigation Counsel with the America First Policy Institute under former Florida Attorney General Pam Bondi, Of Counsel with the Fairness Center, and had his own civil rights and criminal defense law practice in New York City for over a decade. Upon graduating from the Catholic University of America, Columbus School of Law, he clerked for Chief Judge Frederick J. Scullin, Jr., U.S. District Court for the Northern District of New York. Mr. Trainor is admitted to practice law in the state of New York, the U.S. District Court for the Southern and Eastern Districts of New York, and the U.S. Supreme Court.

Madi Biedermann – Deputy Assistant Secretary, Office of Communications and Outreach

Madi Biedermann is an experienced education policy and communications professional with experience spanning both federal and state government and policy advocacy organizations. She most recently worked as the Chief Operating Officer at P2 Public Affairs. Prior to that, she served as an Assistant Secretary of Education for Governor Glenn Youngkin and worked as a Special Assistant and Presidential Management Fellow at the Office of Management and Budget in the first Trump Administration. Madi received her bachelor’s degree and master of public administration from the University of Southern California.

Candice Jackson – Deputy General Counsel

Candice Jackson returns to the U.S. Department of Education to serve as Deputy General Counsel. Candice served in the first Trump Administration as Acting Assistant Secretary for Civil Rights, and Deputy General Counsel, from 2017-2021. For the last few years, Candice has practiced law in Washington State and California and consulted with groups and individuals challenging the harmful effects of the concept of "gender identity" in laws and policies in schools, employment, and public accommodations. Candice is mom to girl-boy twins Madelyn and Zachary, age 11.

Joshua Kleinfeld – Deputy General Counsel

Joshua Kleinfeld is the Allison & Dorothy Rouse Professor of Law and Director of the Boyden Gray Center for the Study of the Administrative State at George Mason University’s Scalia School of Law. He writes and teaches about constitutional law, criminal law, and statutory interpretation, focusing in all fields on whether democratic ideals are realized in governmental practice. As a scholar and public intellectual, he has published work in the Harvard, Stanford, and University of Chicago Law Reviews, among other venues. As a practicing lawyer, he has clerked on the D.C. Circuit, Fourth Circuit, and Supreme Court of Israel, represented major corporations accused of billion-dollar wrongdoing, and, on a pro bono basis, represented children accused of homicide. As an academic, he was a tenured full professor at Northwestern Law School before lateraling to Scalia Law School. He holds a J.D. in law from Yale Law School, a Ph.D. in philosophy from the Goethe University of Frankfurt, and a B.A. in philosophy from Yale College.

Hannah Ruth Earl – Director, Center for Faith-Based and Neighborhood Partnerships

Hannah Ruth Earl is the former executive director of America’s Future, where she cultivated communities of freedom-minded young professionals and local leaders. She previously co-produced award-winning feature films as director of talent and creative development at the Moving Picture Institute. A native of Tennessee, she holds a master of arts in religion from Yale Divinity School.

AFPI Reform Priorities

AFPI's higher education priorities are to:

Reform America’s Dysfunctional Higher Education Accreditation System

Rethink Public Financing of Postsecondary Study to Encourage Competition and Accountability

Combat the Politicization of Higher Education and Encourage Viewpoint Diversity on U.S. Campuses

Related links:

Trump's Education Department dismantles DEI measures, suspends staff (USA Today)Friday, January 17, 2025

Social Security Offsets and Defaulted Student Loans (CFPB)

Executive Summary

When borrowers default on their federal student loans, the U.S. Department of Education (“Department of Education”) can collect the outstanding balance through forced collections, including the offset of tax refunds and Social Security benefits and the garnishment of wages. At the beginning of the COVID-19 pandemic, the Department of Education paused collections on defaulted federal student loans.1 This year, collections are set to resume and almost 6 million student loan borrowers with loans in default will again be subject to the Department of Education’s forced collection of their tax refunds, wages, and Social Security benefits.2 Among the borrowers who are likely to experience forced collections are an estimated 452,000 borrowers ages 62 and older with defaulted loans who are likely receiving Social Security benefits.3

This spotlight describes the circumstances and experiences of student loan borrowers affected by the forced collection of Social Security benefits.4 It also describes how forced collections can push older borrowers into poverty, undermining the purpose of the Social Security program.5

Key findings

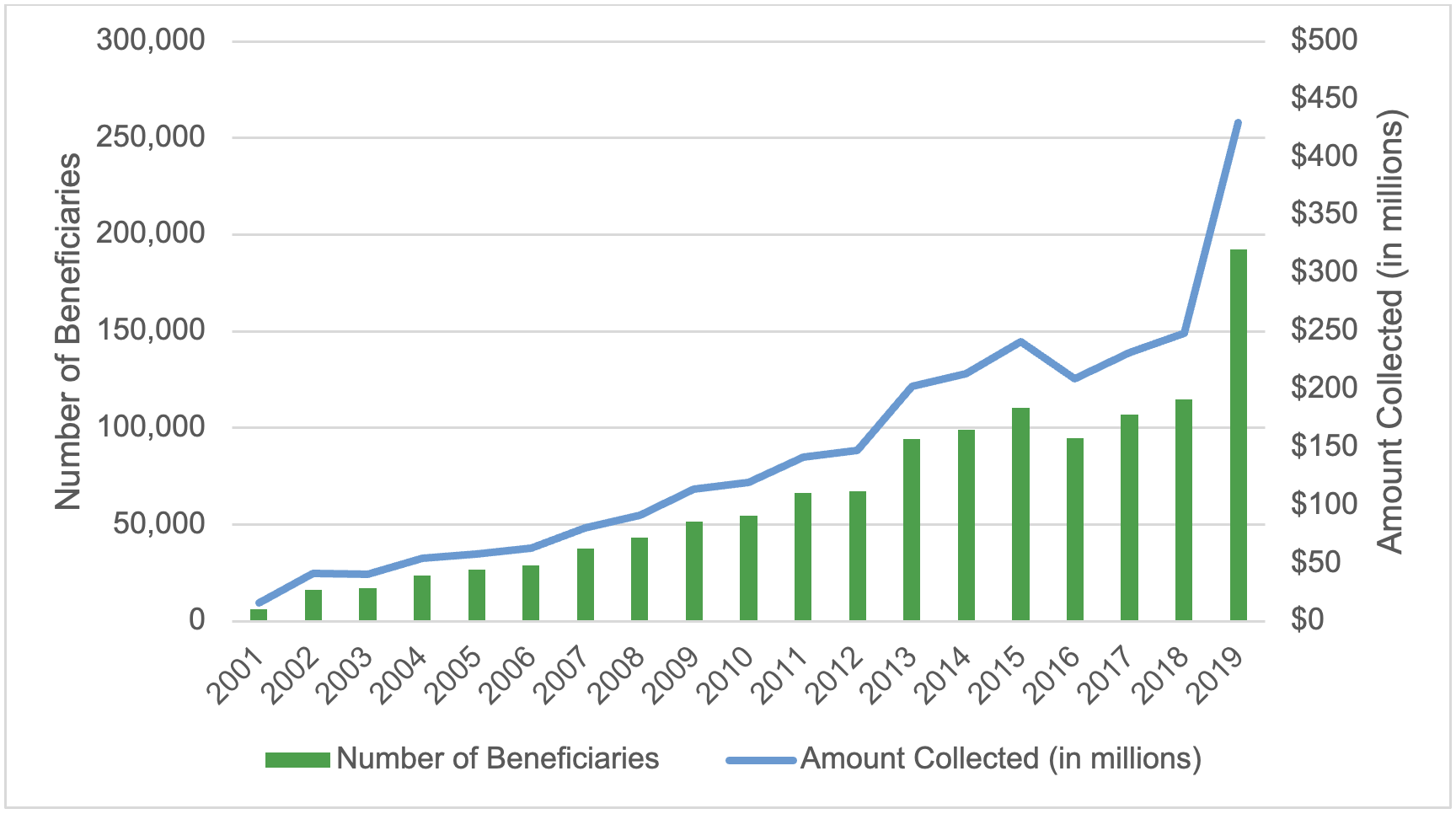

- The number of Social Security beneficiaries experiencing forced collection grew by more than 3,000 percent in fewer than 20 years; the count is likely to grow as the age of student loan borrowers trends older. Between 2001 and 2019, the number of Social Security beneficiaries experiencing reduced benefits due to forced collection increased from approximately 6,200 to 192,300. This exponential growth is likely driven by older borrowers who make up an increasingly large share of the federal student loan portfolio. The number of student loan borrowers ages 62 and older increased by 59 percent from 1.7 million in 2017 to 2.7 million in 2023, compared to a 1 percent decline among borrowers under the age of 62.

- The total amount of Social Security benefits the Department of Education collected between 2001 and 2019 through the offset program increased from $16.2 million to $429.7 million. Despite the exponential increase in collections from Social Security, the majority of money the Department of Education has collected has been applied to interest and fees and has not affected borrowers’ principal amount owed. Furthermore, between 2016 and 2019, the Department of the Treasury’s fees alone accounted for nearly 10 percent of the average borrower’s lost Social Security benefits.

- More than one in three Social Security recipients with student loans are reliant on Social Security payments, meaning forced collections could significantly imperil their financial well-being. Approximately 37 percent of the 1.3 million Social Security beneficiaries with student loans rely on modest payments, an average monthly benefit of $1,523, for 90 percent of their income. This population is particularly vulnerable to reduction in their benefits especially if benefits are offset year-round. In 2019, the average annual amount collected from individual beneficiaries was $2,232 ($186 per month).

- The physical well-being of half of Social Security beneficiaries with student loans in default may be at risk. Half of Social Security beneficiaries with student loans in default and collections skipped a doctor’s visit or did not obtain prescription medication due to cost.

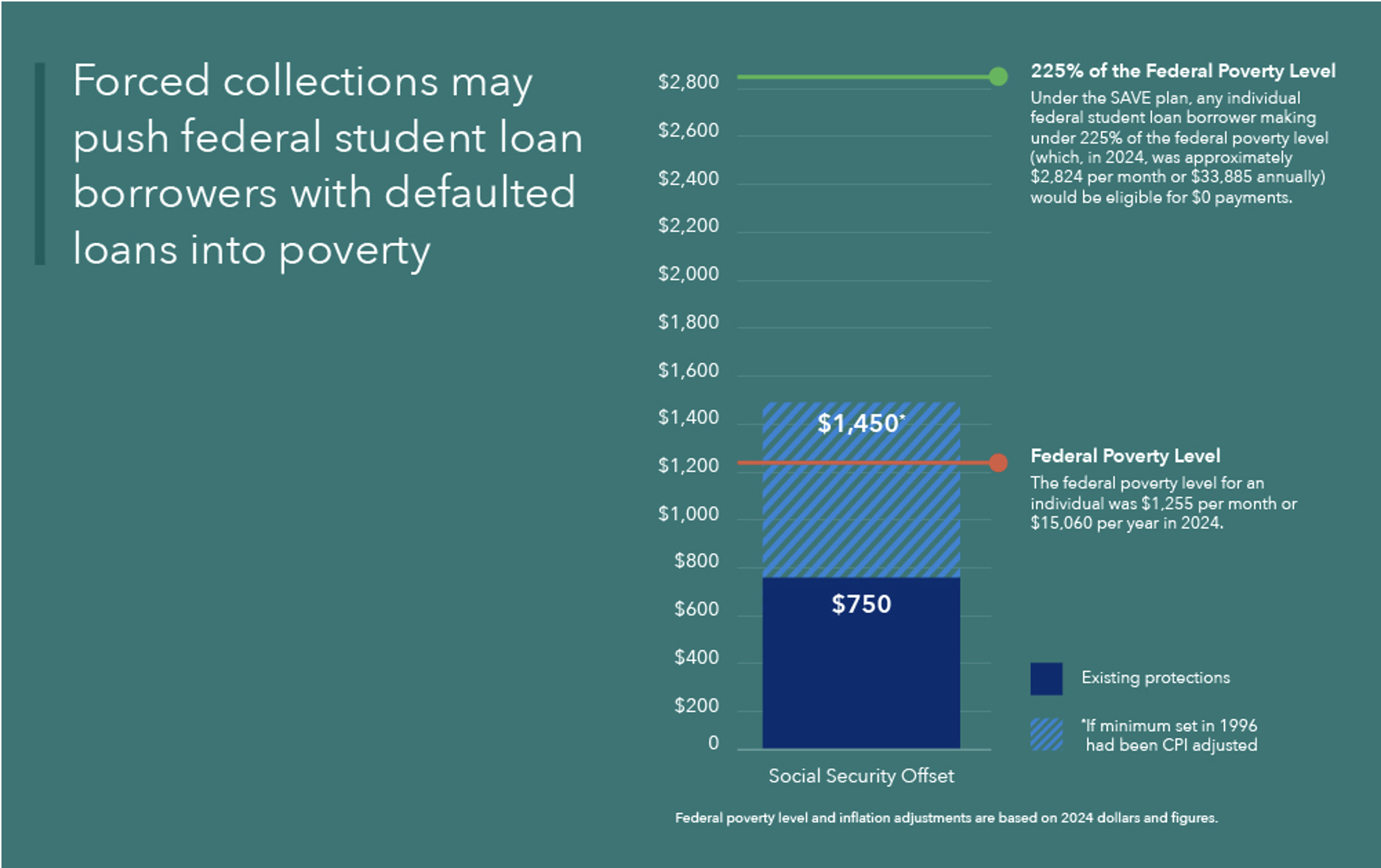

- Existing minimum income protections fail to protect student loan borrowers with Social Security against financial hardship. Currently, only $750 per month of Social Security income—an amount that is $400 below the monthly poverty threshold for an individual and has not been adjusted for inflation since 1996—is protected from forced collections by statute. Even if the minimum protected income was adjusted for inflation, beneficiaries would likely still experience hardship, such as food insecurity and problems paying utility bills. A higher threshold could protect borrowers against hardship more effectively. The CFPB found that for 87 percent of student loan borrowers who receive Social Security, their benefit amount is below 225 percent of the federal poverty level (FPL), an income level at which people are as likely to experience material hardship as those with incomes below the federal poverty level.

- Large shares of Social Security beneficiaries affected by forced collections may be eligible for relief or outright loan cancellation, yet they are unable to access these benefits, possibly due to insufficient automation or borrowers’ cognitive and physical decline. As many as eight in ten Social Security beneficiaries with loans in default may be eligible to suspend or reduce forced collections due to financial hardship. Moreover, one in five Social Security beneficiaries may be eligible for discharge of their loans due to a disability. Yet these individuals are not accessing such relief because the Department of Education’s data matching process insufficiently identifies those who may be eligible.

Taken together, these findings suggest that the Department of Education’s forced collections of Social Security benefits increasingly interfere with Social Security’s longstanding purpose of protecting its beneficiaries from poverty and financial instability.

Introduction

When borrowers default on their federal student loans, the Department of Education can collect the outstanding balance through forced collections, including the offset of tax refunds and Social Security benefits, and the garnishment of wages. At the beginning of the COVID-19 pandemic, the Department of Education paused collections on defaulted federal student loans. This year, collections are set to resume and almost 6 million student loan borrowers with loans in default will again be subject to the Department of Education’s forced collection of their tax refunds, wages, and Social Security benefits.6

Among the borrowers who are likely to experience the Department of Education’s renewed forced collections are an estimated 452,000 borrowers with defaulted loans who are ages 62 and older and who are likely receiving Social Security benefits.7 Congress created the Social Security program in 1935 to provide a basic level of income that protects insured workers and their families from poverty due to situations including old age, widowhood, or disability.8 The Social Security Administration calls the program “one of the most successful anti-poverty programs in our nation's history.”9 In 2022, Social Security lifted over 29 million Americans from poverty, including retirees, disabled adults, and their spouses and dependents.10 Congress has recognized the importance of securing the value of Social Security benefits and on several occasions has intervened to protect them.11

This spotlight describes the circumstances and experiences of student loan borrowers affected by the forced collection of their Social Security benefits.12 It also describes how the purpose of Social Security is being increasingly undermined by the limited and deficient options the Department of Education has to protect Social Security beneficiaries from poverty and hardship.

The forced collection of Social Security benefits has increased exponentially.

Federal student loans enter default after 270 days of missed payments and transfer to the Department of Education’s default collections program after 360 days. Borrowers with a loan in default face several consequences: (1) their credit is negatively affected; (2) they lose eligibility to receive federal student aid while their loans are in default; (3) they are unable to change repayment plans and request deferment and forbearance;13 and (4) they face forced collections of tax refunds, Social Security benefits, and wages among other payments.14 To conduct its forced collections of federal payments like tax refunds and Social Security benefits, the Department of Education relies on a collection service run by the U.S. Department of the Treasury called the Treasury Offset Program.15

Between 2001 and 2019, the number of student loan borrowers facing forced collection of their Social Security benefits increased from at least 6,200 to 192,300.16 That is a more than 3,000 percent increase in fewer than 20 years. By comparison, the number of borrowers facing forced collections of their tax refunds increased by about 90 percent from 1.17 million to 2.22 million during the same period.17

This exponential growth of Social Security offsets between 2001 and 2019 is likely driven by multiple factors including:

- Older borrowers accounted for an increasingly large share of the federal student loan portfolio due to increasing average age of enrollment and length of time in repayment. Data from the Department of Education (which is only available since 2017), show that the number of student loan borrowers ages 62 and older, increased 24 percent from 1.7 million in 2017 to 2.1 million in 2019, compared to less than 1 percent among borrowers under the age of 62.18

- A larger number of borrowers, especially older borrowers, had loans in default. Data from the Department of Education show that the number of student loan borrowers with a defaulted loan increased by 230 percent from 3.8 million in 2006 to 8.8 million in 2019.19 Compounding these trends is the fact that older borrowers are twice as likely to have a loan in default than younger borrowers.20

Due to these factors, the total amount of Social Security benefits the Department of Education collected between 2001 and 2019 through the offset program increased annually from $16.2 million to $429.7 million (when adjusted for inflation).21 This increase occurred even though the average monthly amount the Department of Education collected from individual beneficiaries was the same for most years, at approximately $180 per month.22

Figure 1: Number of Social Security beneficiaries and total amount collected for student loans (2001-2019)

Source: CFPB analysis of public data from U.S. Treasury’s Fiscal Data portal. Amounts are presented in 2024 dollars.

While the total collected from Social Security benefits has increased exponentially, the majority of money the Department of Education collected has not been applied to borrowers’ principal amount owed. Specifically, nearly three-quarters of the monies the Department of Education collects through offsets is applied to interest and fees, and not towards paying down principal balances.23 Between 2016 and 2019, the U.S. Department of the Treasury charged the Department of Education between $13.12 and $15.00 per Social Security offset, or approximately between $157.44 and $180 for 12 months of Social Security offsets per beneficiary with defaulted federal student loans.24 As a matter of practice, the Department of Education often passes these fees on directly to borrowers.25 Furthermore, these fees accounted for nearly 10 percent of the average monthly borrower’s lost Social Security benefits which was $183 during this time.26 Interest and fees not only reduce beneficiaries’ monthly benefits, but also prolong the period that beneficiaries are likely subject to forced collections.

Forced collections are compromising Social Security beneficiaries’ financial well-being.

Forced collection of Social Security benefits affects the financial well-being of the most vulnerable borrowers and can exacerbate any financial and health challenges they may already be experiencing. The CFPB’s analysis of the Survey of Income and Program Participation (SIPP) pooled data for 2018 to 2021 finds that Social Security beneficiaries with student loans receive an average monthly benefit of $1,524.27 The analysis also indicates that approximately 480,000 (37 percent) of the 1.3 million beneficiaries with student loans rely on these modest payments for 90 percent or more of their income,28 thereby making them particularly vulnerable to reduction in their benefits especially if benefits are offset year-round. In 2019, the average annual amount collected from individual beneficiaries was $2,232 ($186 per month).29

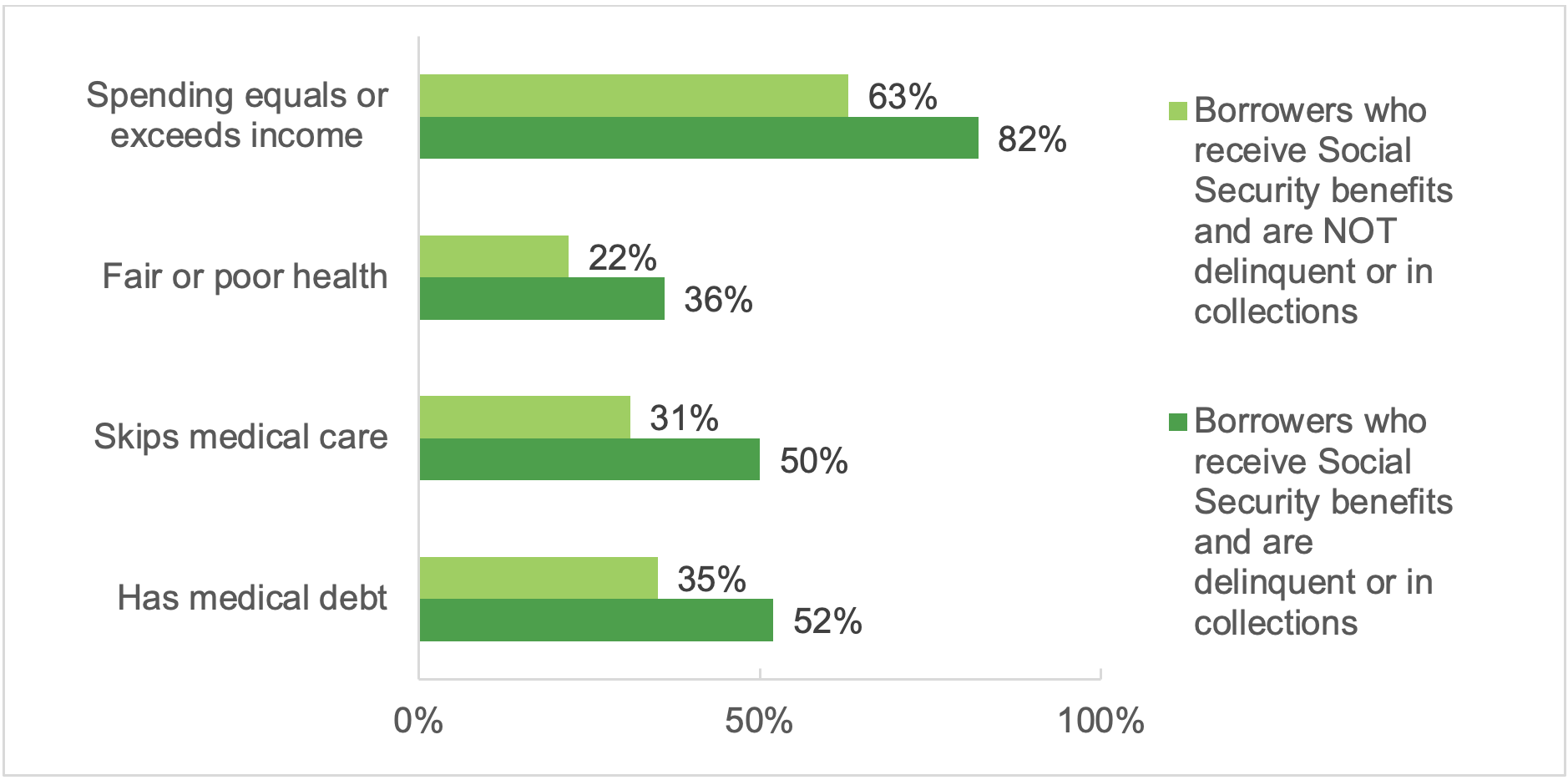

A recent survey from The Pew Charitable Trusts found that more than nine in ten borrowers who reported experiencing wage garnishment or Social Security payment offsets said that these penalties caused them financial hardship.30 Consequently, for many, their ability to meet their basic needs, including access to healthcare, became more difficult. According to our analysis of the Federal Reserve’s Survey of Household Economic and Decision-making (SHED), half of Social Security beneficiaries with defaulted student loans skipped a doctor’s visit and/or did not obtain prescription medication due to cost.31 Moreover, 36 percent of Social Security beneficiaries with loans in delinquency or in collections report fair or poor health. Over half of them have medical debt.32

Figure 2: Selected financial experiences and hardships among subgroups of loan borrowers

Source: CFPB analysis of the Federal Reserve Board Survey of Household Economic and Decision-making (2019-2023).

Social Security recipients subject to forced collection may not be able to access key public benefits that could help them mitigate the loss of income. This is because Social Security beneficiaries must list the unreduced amount of their benefits prior to collections when applying for other means-tested benefits programs such as Social Security Insurance (SSI), Supplemental Nutrition Assistance Program (SNAP), and the Medicare Savings Programs.33 Consequently, beneficiaries subject to forced collections must report an inflated income relative to what they are actually receiving. As a result, these beneficiaries may be denied public benefits that provide food, medical care, prescription drugs, and assistance with paying for other daily living costs.34

Consumers’ complaints submitted to the CFPB describe the hardship caused by forced collections on borrowers reliant on Social Security benefits to pay for essential expenses.35 Consumers often explain their difficulty paying for such expenses as rent and medical bills. In one complaint, a consumer noted that they were having difficulty paying their rent since their Social Security benefit usually went to paying that expense.36 In another complaint, a caregiver described that the money was being withheld from their mother’s Social Security, which was the only source of income used to pay for their mother’s care at an assisted living facility.37 As forced collections threaten the housing security and health of Social Security beneficiaries, they also create a financial burden on non-borrowers who help address these hardships, including family members and caregivers.

Existing minimum income protections fail to protect student loan borrowers with Social Security against financial hardship.

The Debt Collection Improvement Act set a minimum floor of income below which the federal government cannot offset Social Security benefits and subsequent Treasury regulations established a cap on the percentage of income above that floor.38 Specifically, these statutory guardrails limit collections to 15 percent of Social Security benefits above $750. The minimum threshold was established in 1996 and has not been updated since. As a result, the amount protected by law alone does not adequately protect beneficiaries from financial hardship and in fact no longer protects them from falling below the federal poverty level (FPL). In 1996, $750 was nearly $100 above the monthly poverty threshold for an individual.39 Today that same protection is $400 below the threshold. If the protected amount of $750 per month ($9,000 per year) set in 1996 was adjusted for inflation, in 2024 dollars, it would total $1,450 per month ($17,400 per year).40

Figure 3: Comparison of monthly FPL threshold with the current protected amount established in 1996 and the amount that would be protected with inflation adjustment

Source: Calculations by the CFPB. Notes: Inflation adjustments based on the consumer price index (CPI).

Even if the minimum protected income of $750 is adjusted for inflation, beneficiaries will likely still experience hardship as a result of their reduced benefits. Consumers with incomes above the poverty line also commonly experience material hardship.41 This suggests that a threshold that is higher than the poverty level will more effectively protect against hardship.42 Indeed, in determining an income threshold for $0 payments under the SAVE plan, the Department of Education researchers used material hardship (defined as being unable to pay utility bills and reporting food insecurity) as their primary metric, and found similar levels of material hardship among those with incomes below the poverty line and those with incomes up to 225 percent of the FPL.43 Similarly, the CFPB’s analysis of a pooled sample of SIPP respondents finds the same levels of material hardship for Social Security beneficiaries with student loans with incomes below 100 percent of the FPL and those with incomes up to 225 percent of the FPL.44 The CFPB found that for 87 percent of student loan borrowers who receive Social Security, their benefit amount is below 225 percent of the FPL.45 Accordingly, all of those borrowers would be removed from forced collections if the Department of Education applied the same income metrics it established under the SAVE program to an automatic hardship exemption program.

Existing options for relief from forced collections fail to reach older borrowers.

Borrowers with loans in default remain eligible for certain types of loan cancellation and relief from forced collections. However, our analysis suggests that these programs may not be reaching many eligible consumers. When borrowers do not benefit from these programs, their hardship includes, but is not limited to, unnecessary losses to their Social Security benefits and negative credit reporting.

Borrowers who become disabled after reaching full retirement age may miss out on Total and Permanent Disability

The Total and Permanent Disability (TPD) discharge program cancels federal student loans and effectively stops all forced collections for disabled borrowers who meet certain requirements. After recent revisions to the program, this form of cancelation has become common for those borrowers with Social Security who became disabled prior to full retirement age.46 In 2016, a GAO study documented the significant barriers to TPD that Social Security beneficiaries faced.47 To address GAO’s concerns, the Department of Education in 2021 took a series of mitigating actions, including entering into a data-matching agreement with the Social Security Administration (SSA) to automate the TPD eligibility determination and discharge process.48 This process was expanded further with new final rules being implemented July 1, 2023 that expanded the categories of borrowers eligible for automatic TPD cancellation.49 In total, these changes successfully resulted in loan cancelations for approximately 570,000 borrowers.50

However, the automation and other regulatory changes did not significantly change the application process for consumers who become disabled after they reach full retirement age or who have already claimed the Social Security retirement benefits. For these beneficiaries, because they are already receiving retirement benefits, SSA does not need to determine disability status. Likewise, SSA does not track disability status for those individuals who become disabled after they start collecting their Social Security retirement benefits.51

Consequently, SSA does not transfer information on disability to the Department of Education once the beneficiary begins collecting Social Security retirement.52 These individuals therefore will not automatically get a TPD discharge of their student loans, and they must be aware and physically and mentally able to proactively apply for the discharge.53

The CFPB’s analysis of the Census survey data suggests that the population that is excluded from the TPD automation process could be substantial. More than one in five (22 percent) Social Security beneficiaries with student loans are receiving retirement benefits and report a disability such as a limitation with vision, hearing, mobility, or cognition.54 People with dementia and other cognitive disabilities are among those with the greatest risk of being excluded, since they are more likely to be diagnosed after the age 70, which is the maximum age for claiming retirement benefits.55

These limitations may also help explain why older borrowers are less likely to rehabilitate their defaulted student loans. Specifically, 11 percent of student loan borrowers ages 50 to 59 facing forced collections successfully rehabilitated their loans,56 while only five percent of borrowers over the age of 75 do so.57

Figure 4: Number of student loan borrowers ages 50 and older in forced collection, borrowers who signed a rehabilitation agreement, and borrowers who successfully rehabilitated a loan by selected age groups

| Age Group | Number of Borrowers in Offset | Number of Borrowers Who Signed a Rehabilitation Agreement | Percent of Borrowers Who Signed a Rehabilitation Agreement | Number of Borrowers Successfully Rehabilitated | Percent of Borrowers who Successfully Rehabilitated |

|---|---|---|---|---|---|

| 50 to 59 | 265,200 | 50,800 | 14% | 38,400 | 11% |

| 60 to 74 | 184,900 | 24,100 | 11% | 18,500 | 8% |

| 75 and older | 15,800 | 1,000 | 6% | 800 | 5% |

Source: CFPB analysis of data provided by the Department of Education.

Shifting demographics of student loan borrowers suggest that the current automation process may become less effective to protect Social Security benefits from forced collections as more and more older adults have student loan debt. The fastest growing segment of student loan borrowers are adults ages 62 and older. These individuals are generally eligible for retirement benefits, not disability benefits, because they cannot receive both classifications at the same time. Data from the Department of Education reflect that the number of student loan borrowers ages 62 and older increased by 59 percent from 1.7 million in 2017 to 2.7 million in 2023. In comparison, the number of borrowers under the age of 62 remained unchanged at 43 million in both years.58 Furthermore, additional data provided to the CFPB by the Department of Education show that nearly 90,000 borrowers ages 81 and older hold an average amount of $29,000 in federal student loan debt, a substantial amount despite facing an estimated average life expectancy of less than nine years.59

Existing exceptions to forced collections fail to protect many Social Security beneficiaries

In addition to TPD discharge, the Department of Education offers reduction or suspension of Social Security offset where borrowers demonstrate financial hardship.60 To show hardship, borrowers must provide documentation of their income and expenses, which the Department of Education then uses to make its determination.61 Unlike the Debt Collection Improvement Act’s minimum protections, the eligibility for hardship is based on a comparison of an individual’s documented income and qualified expenses. If the borrower has eligible monthly expenses that exceed or match their income, the Department of Education then grants a financial hardship exemption.62

The CFPB’s analysis suggests that the vast majority of Social Security beneficiaries with student loans would qualify for a hardship protection. According to CFPB’s analysis of the Federal Reserve Board’s SHED, eight in ten (82 percent) of Social Security beneficiaries with student loans in default report that their expenses equal or exceed their income.63 Accordingly, these individuals would likely qualify for a full suspension of forced collections. Yet the GAO found that in 2015 (when the last data was available) less than ten percent of Social Security beneficiaries with forced collections applied for a hardship exemption or reduction of their offset.64 A possible reason for the low uptake rate is that many beneficiaries or their caregivers never learn about the hardship exemption or the possibility of a reduction in the offset amount.65 For those that do apply, only a fraction get relief. The GAO study found that at the time of their initial offset, only about 20 percent of Social Security beneficiaries ages 50 and older with forced collections were approved for a financial hardship exemption or a reduction of the offset amount if they applied.66

Conclusion

As hundreds of thousands of student loan borrowers with loans in default face the resumption of forced collection of their Social Security benefits, this spotlight shows that the forced collection of Social Security benefits causes significant hardship among affected borrowers. The spotlight also shows that the basic income protections aimed at preventing poverty and hardship among affected borrowers have become increasingly ineffective over time. While the Department of Education has made some improvements to expand access to relief options, especially for those who initially receive Social Security due to a disability, these improvements are insufficient to protect older adults from the forced collection of their Social Security benefits.

Taken together, these findings suggest that forced collections of Social Security benefits increasingly interfere with Social Security’s longstanding purpose of protecting its beneficiaries from poverty and financial instability. These findings also suggest that alternative approaches are needed to address the harm that forced collections cause on beneficiaries and to compensate for the declining effectiveness of existing remedies. One potential solution may be found in the Debt Collection Improvement Act, which provides that when forced collections “interfere substantially with or defeat the purposes of the payment certifying agency’s program” the head of an agency may request from the Secretary of the Treasury an exemption from forced collections.67 Given the data findings above, such a request for relief from the Commissioner of the Social Security Administration on behalf of Social Security beneficiaries who have defaulted student loans could be justified. Unless the toll of forced collections on Social Security beneficiaries is considered alongside the program’s stated goals, the number of older adults facing these challenges is only set to grow.

Data and Methodology

To develop this report, the CFPB relied primarily upon original analysis of public-use data from the U.S. Census Bureau Survey of Income and Program Participation (SIPP), the Federal Reserve Board Board’s Survey of Household Economics and Decision-making (SHED), U.S. Department of the Treasury, Fiscal Data portal, consumer complaints received by the Bureau, and administrative data on borrowers in default provided by the Department of Education. The report also leverages data and findings from other reports, studies, and sources, and cites to these sources accordingly. Readers should note that estimates drawn from survey data are subject to measurement error resulting, among other things, from reporting biases and question wording.

Survey of Income and Program Participation

The Survey of Income and Program Participation (SIPP) is a nationally representative survey of U.S. households conducted by the U.S. Census Bureau. The SIPP collects data from about 20,000 households (40,000 people) per wave. The survey captures a wide range of characteristics and information about these households and their members. The CFPB relied on a pooled sample of responses from 2018, 2019, 2020, and 2021 waves for a total number of 17,607 responses from student loan borrowers across all waves, including 920 respondents with student loans receiving Social Security benefits. The CFPB’s analysis relied on the public use data. To capture student loan debt, the survey asked to all respondents (variable EOEDDEBT): Owed any money for student loans or educational expenses in own name only during the reference period. To capture receipt of Social Security benefits, the survey asked to all respondents (variable ESSSANY): “Did ... receive Social Security benefits for himself/herself at any time during the reference period?” To capture amount of Social Security benefits, the survey asked to all respondents (variable TSSSAMT): “How much did ... receive in Social Security benefit payment in this month (1-12), prior to any deductions for Medicare premiums?”

The public-use version of the survey dataset, and the survey documentation can be found at: https://www.census.gov/programs-surveys/sipp.html

Survey of Household Economics and Decision-making

The Federal Reserve Board’s Survey of Household Economics and Decision-making (SHED) is an annual web-based survey of households. The survey captures information about respondents’ financial situations. The CFPB relied on a pooled sample of responses from 2019 through 2023 waves for a total number of 1,376 responses from student loan borrowers in collection across all waves. The CFPB analysis relied on the public use data. To capture default and collection, the survey asked all respondents with student loans (variable SL6): “Are you behind on payments or in collections for one or more of the student loans from your own education?” To capture receipt of Social Security benefits, the survey asked to all respondents (variable I0_c): “In the past 12 months, did you (and/or your spouse or partner) receive any income from the following sources: Social Security (including old age and DI)?”

The public-use version of the survey dataset, and the survey documentation can be found at https://www.federalreserve.gov/consumerscommunities/shed_data.htm

Appendix A: Number of student loan borrowers ages 60 and older, total outstanding balance, and average balance by age group, August 2024

| Age Group | Borrower Count (in thousands) | Balance (in billions) | Average balance |

|---|---|---|---|

60 to 65 |

1,951.4 |

$87.49 |

$44,834 |

66 to 70 |

909.8 |

$39.47 |

$43,383 |

71 to 75 |

457.5 |

$18.95 |

$41,421 |

76 to 80 |

179.0 |

$6.80 |

$37,989 |

81 to 85 |

59.9 |

$1.90 |

$31,720 |

86 to 90 |

20.1 |

$0.51 |

$25,373 |

91 to 95 |

7.0 |

$0.14 |

$20,000 |

96+ |

2.8 |

$0.05 |

$17,857 |

Source: Data provided by the Department of Education.

The endnotes for this report are available here.

Biden-Harris Administration Announces Final Student Loan Forgiveness and Borrower Assistance Actions (US Department of Education)

Total Approved Student Debt Relief Reached Almost $189 Billion for 5.3 Million Borrowers

The Biden-Harris Administration today announced its final round of student loan forgiveness, approving more than $600 million for 4,550 borrowers through the Income-Based Repayment (IBR) Plan and 4,100 individual borrower defense approvals. The Administration leaves office having approved a cumulative $188.8 billion in forgiveness for 5.3 million borrowers across 33 executive actions. The U.S. Department of Education (Department) today also announced that it has completed the income-driven repayment payment count adjustment and that borrowers will now be able to see their income-driven repayment counters when they log into their accounts on StudentAid.gov. Finally, the Department took additional actions that will allow students who attended certain schools that have since closed to qualify for student loan discharges.

“Four years ago, President Biden made a promise to fix a broken student loan system. We rolled up our sleeves and, together, we fixed existing programs that had failed to deliver the relief they promised, took bold action on behalf of borrowers who had been cheated by their institutions, and brought financial breathing room to hardworking Americans—including public servants and borrowers with disabilities. Thanks to our relentless, unapologetic efforts, millions of Americans are approved for student loan forgiveness,” said U.S. Secretary of Education Miguel Cardona. “I’m incredibly proud of the Biden-Harris Administration’s historic achievements in making the life-changing potential of higher education more affordable and accessible for more people.”

From Day One the Biden-Harris Administration took steps to rethink, restore, and revitalize targeted relief programs that entitle borrowers to relief under the Higher Education Act but that failed to live up to their promises. Through a combination of executive actions and regulatory improvements, the Biden-Harris Administration produced the following results for borrowers:

Fixed longstanding problems with Income-Driven Repayment (IDR). The Administration has approved 1.45 million borrowers for $57.1 billion in loan relief, including $600 million for 4,550 borrowers announced today for IBR forgiveness.

IDR plans help keep payments manageable for borrowers and have provided a path to forgiveness after an extended period. These plans started in the early 1990s, but prior to the Biden-Harris Administration taking office, just 50 borrowers had ever had their loans forgiven. The Administration corrected longstanding failures to accurately track borrower progress toward forgiveness and addressed past instances of forbearance steering whereby servicers inappropriately advised borrowers to postpone payments for extended periods of time. These totals also include borrowers who received forgiveness under the Saving on a Valuable Education (SAVE) plan prior to court orders halting forgiveness under the SAVE plan.

Today, the Department also announced the completion of the IDR payment count adjustment, correcting eligible payment counts. While the payment count adjustment is now complete, borrowers who were affected by certain servicer transitions in 2024 may see one or two additional months credited in the coming weeks. The Department is also launching the ability for borrowers to track their IDR progress on StudentAid.gov. Borrowers can now log in to their accounts and see their total IDR payment count and a month-by-month breakdown of progress.

Restored the promise of Public Service Loan Forgiveness (PSLF). The Administration has approved 1,069,000 borrowers for $78.5 billion in forgiveness.

The PSLF Program provides critical support to teachers, service members, social workers, and others engaged in public service. But prior to this Administration taking office, just 7,000 borrowers had received forgiveness and the overwhelming majority of borrowers who applied had their applications denied. The Biden-Harris Administration fixed this program by pursuing regulatory improvements, correcting long-standing issues with tracking progress toward forgiveness and misuse of forbearances, and implementing the limited PSLF waiver to avoid harm from the pandemic.

Automated discharges and simplified eligibility criteria for borrowers with a total and permanent disability. The Administration has approved 633,000 borrowers for $18.7 billion in loan relief.

Borrowers who are totally and permanently disabled may be eligible for a total and permanent disability (TPD) discharge. The Biden-Harris Administration changed regulations to automatically forgive loans for eligible borrowers based upon a data match with the Social Security Administration (SSA). This helped hundreds of thousands of borrowers who were eligible for relief but hadn’t managed to navigate paperwork requirements. The Department also made it easier for borrowers to qualify for relief based upon SSA determinations, made it easier to complete the TPD application, and eliminated provisions that had caused many borrowers to have their loans reinstated.

Delivered long-awaited help to borrowers ripped off by their institutions, whose schools closed, or through related court settlements. The Administration has approved just under 2 million borrowers for $34.5 billion in loan relief.

For years, students had sought relief from the Department through borrower defense to repayment—a provision that allows borrowers to have their loans forgiven if their college engaged in misconduct related to the borrowers’ loans. The Department delivered long-awaited relief to borrowers who attended some of the most notoriously predatory institutions to ever participate in the federal financial aid programs. This included approving for discharge all remaining outstanding loans from Corinthian Colleges, as well as group discharges for ITT Technical Institute, the Art Institutes, Westwood College, Ashford University, and others. The Department also settled a long-running class action lawsuit stemming from allegations of inaction and the issuance of form denials, allowing it to begin the first sustained denials of non-meritorious claims.

Today, the Department also approved 4,100 additional individual borrower defense applications for borrowers who attended DeVry University, based upon findings announced in February 2022.

“For decades, the federal government promised to help people who couldn’t afford their student loans because they were in public service, had disabilities, were cheated by their college, or who had completed decades of payments. But it rarely kept those promises until now,” said U.S. Under Secretary of Education James Kvaal. “These permanent reforms have already helped more 5 million borrowers, and many more borrowers will continue to benefit.”

The table below compares the progress made by the Biden-Harris Administration in these key discharge areas compared to other administrations.

| Borrowers approved for forgiveness | ||

| Prior Administrations | Biden-Harris Administration | |

| Borrower Defense (Since 2015) | 53,500 | 1,767,000* |

| Public Service Loan Forgiveness (Since 2017) | 7,000 | 1,069,000 |

| Income-Driven Repayment (all-time) | 50 | 1,454,000 |

| Total and Permanent Disability (Since 2017) | 604,000 | 633,000 |

* Includes 107,000 borrowers and $1.25 billion captured by an extension of the closed-school lookback window at ITT Technical Institute.

Additional actions related to closed school discharges

The Department today also announced additional actions that will make more borrowers eligible for a closed school loan discharge. Generally, a borrower qualifies for a closed school discharge if they did not complete their program and were either still enrolled when the school closed or left without graduating within 120 days before it closed. . However, the Department has determined that several schools closed under exceptional circumstances that merit allowing borrowers who did complete and were enrolled in the school more than 120 days prior to the closure to qualify for a closed school discharge. justify extending the look-back window beyond the applicable 120 or 180 days--allowing additional borrowers to qualify for a closed school discharge. Generally, eligible borrowers will have to apply for these discharges, but the Secretary has directed Federal Student Aid to make borrowers aware of their eligibility, and to pursue automatic discharges for those affected by closures that took place between 2013 and 2020 and who did not enroll elsewhere within three years of their school closing.

These adjusted look-back windows are:

- To May 6, 2015, for all campuses owned at the time by the Career Education Corporation (CEC), which have since closed. That is the day CEC announced it would close or sell all campuses except for two brands. This affected the Art Institutes, Le Cordon Bleu, Brooks Institute, Missouri College, Briarcliffe College, and Sanford-Brown.

- To December 16, 2016, for campuses owned by the Education Corporation of America (ECA) on that date that closed. ECA operated Virginia College, Brightwood College, EcoTech, and Golf Academies and started on the path to closure after its accreditation agency lost federal recognition and ECA could not obtain accreditation elsewhere.

- To October 17, 2017 for all campuses owned or sold on that date by the Education Management Corporation (EDMC) and that later closed. That is the day EDMC sold substantially all of its assets to Dream Center Educational Holdings. The decision affects borrowers who attended the Art Institutes, including the Miami International University of Art & Design and Argosy University.

- To April 23, 2021, for Bay State College. That is the day this Massachusetts-based college began to face significant accreditation challenges, which eventually led to the school losing accreditation and closing in August 2023.

Borrowers who want more information about closed school discharge, including how to apply, can visit StudentAid.gov/closedschool.

A state-by-state breakdown of various forms of student debt relief approved by the Biden-Harris Administration is available here.